Key learnings from Bet on your books

Record keeping is a job most of us dislike, dodge and don’t know if we’re doing well. However, good records are critical to managing a grazing business well, especially in variable seasons.

In July, GrazingFutures, in collaboration with Rachel Nixon Bookkeeping, delivered three Bet on your books bookkeeping workshops throughout south west Queensland. The workshops were designed to help producers streamline their office practices and cover the basics of getting their books on the straight and narrow.

The Bet on your books workshops focused on the importance of keeping good tax and GST records in meeting legal obligations and guiding business decisions. Streamlining Business Activity Statements (BAS), establishing manual and/or cloud filing systems, choosing the correct accounting software and organising your chart of accounts (COA) were also discussed.

Key learnings from the workshops

Establishing basic office efficiency:

Quick tips:

- Create an ‘enjoyable’ office space free from distraction

- Establish a routine e.g. set a consistent office day each week

- Invest in a second monitor

It’s worthwhile attempting to establish a consistent office routine, with some workshop attendees finding that dedicating a certain day each week to office work had improved their efficiency drastically. The time of day you choose to complete office work should also be considered, some find they are most productive in the morning, others at night when the kids are asleep. Office routines are not one size fits all, find something that works best for you and your business, it may take some trial and error to work out how you work most effectively.

Office set-up is also an important component to consider, having an office space where you feel comfortable and focused is essential to productivity. Other than having an organised and dedicated workspace, many of the workshop attendees agreed that investing in a second screen would make their time in the office easier.

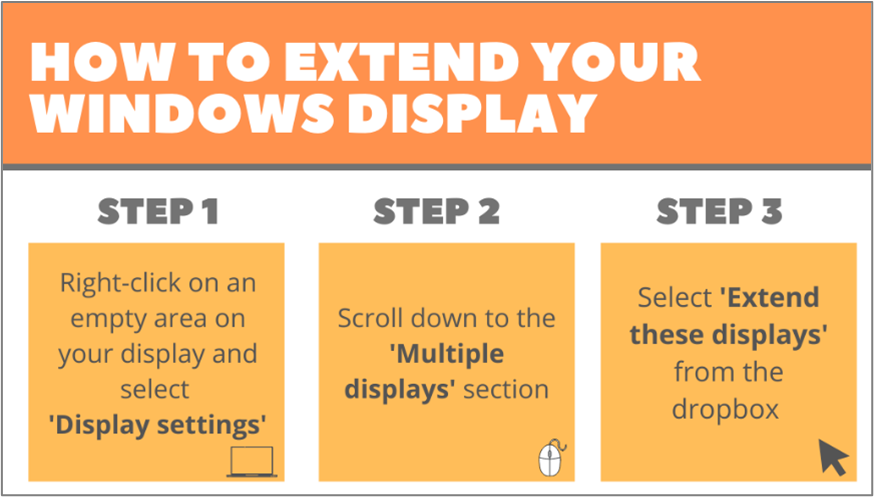

The ability to extend your display onto another monitor avoids flicking back and forth from one document to another, which is particularly useful when completing data entry and results in less errors. It’s essentially like having two pages of the same book open at the same time. The second screen ultimately saves time when completing tasks, and can reduce or eliminate printing, further improving office efficiency.

Structuring your chart of accounts (COA):

Quick tips:

- Create ‘ground rules’ to aid when categorising transactions

- Keep it as simple as functionally possible and remain consistent

- Investing in professional help may be useful when setting up a new, or refining an existing, COA

Having a correctly structured COA and using it consistently is crucial for business management and office efficiency. A COA groups together transactions of a similar type which is not only important for your bookkeeper and accountant but also allows you to drill down on costs from specific areas of your business e.g. money spent on supplementation.

Consistent use of your COA can be tricky especially when there are multiple people involved in allocating transactions. It was suggested during the workshop that creating, and writing down, ‘ground rules’ for costing different types of transactions, especially uncommon ones, can be useful. These rules will form a point of reference for all those involved in the business making for consistent categorising in future and saving your bookkeeper or accountant from having to rearrange transactions, and therefore potentially saving you professional fees.

It’s an important to weigh the cost vs benefit of having more categories than functionally ‘necessary’. If those extra categories create more work, are they providing you with more meaningful reporting outputs or is it just costing you time, thus money? Investing in professional help to set up a new COA or refine an existing one may be beneficial to ensure your COA is functioning as efficiently as possible.

Employee or a contractor?

Quick tips:

- Knowing the difference between an employee and a contractor is important for tax and superannuation reasons

- It’s your legal obligation as an employer to ensure the working arrangement is correct

- To determine the difference it’s important to review the entire working arrangement

- Help is available if you are unsure

If you hire workers, it’s important to know whether they are considered an employee or a contractor for tax and super purposes. The way your worker is categorised determines your tax and super obligations as an employer. Depending on this you may have to withhold tax from their wages, pay super and fringe benefits tax and report this information to the Australian Taxation Office (ATO). Penalties and charges may apply if you get this wrong.

There are many factors that need to be considered when determining whether your worker is an employee or contractor, such as the workers ability to subcontract or delegate tasks, the basis of payment, level of control over the work completed and more. For more detailed information on these considerations click here.

For more information visit the ATO website or seek professional advice.

Conclusion

Thirty-one people attended the three Bet on your books workshops across the south west with the average satisfaction and value ratings being 9.2/10 and 8.9/10, respectively. Twenty-two attendees intended to implement some changes in their business management and record keeping, with eighteen of these being either likely or very likely to make a change. A producer who attended a 2019 Bet on your books workshop invested in professional help after the workshop. Whilst working with the professional this producer was able to successfully recoup thousands in fuel tax credits, GST and other tax related items after discovering they had been recording these details incorrectly.

Further business literacy workshops will be run throughout south west Queensland by the GrazingFutures team. To keep up to date with workshops coming to your area visit the FutureBeef calendar. GrazingFutures support of these business literacy workshops is critical in building drought-ready livestock operations in south west Queensland.

Written by Caitlyn Frazer (DAF, Charleville) and reviewed by Pip Gilmore (DAF, Longreach).

GrazingFutures is an initiative of the Queensland Government to improve drought preparedness and resilience for Queensland producers.